The Hotel Media Review of 2025 - Zeitgeist of the Hotel Industry

Every year, I do the same slightly obsessive exercise: I take the most viewed headlines, strip them of opinion, and look at them as data. This year’s dataset was broader than usual, over 150 of the most-read headlines from 10 Minutes Hotel News, Hospitality Today, and HospitalityNet, (sign up to their newsletters) and the patterns were similar to what we’ve seen before - but different enough.

As always, a reminder: this is not a content quality analysis. This is a click analysis. What people found interesting enough to open. That alone already tells us something about sentiment, uncertainty, and curiosity.

Note this was first published to subscribers of Tell Newsletter (free newsletter of hotel marketing and tech trends).

The Hot Topics

Hotel & Industry Trends: the discomfort of uncertainty?

Hotel and industry trends once again topped the list, but this year the category had a noticeably different texture. Three themes kept repeating:

Market performance snapshots

A large share of the most-clicked articles were essentially pulse checks: how the U.S. market performed this quarter, this half year, or compared to last year. This wasn’t limited to the U.S., but America clearly dominated attention. I don’t recall seeing this level of appetite for near-real-time performance updates in previous years. It suggests an industry that is watching the dashboard more closely than the road ahead.

Macro uncertainty translated into micro analysis

Instead of big “future of travel” narratives, many headlines focused on short-term indicators: demand softness, ADR stabilization, regional divergence. This feels less like optimism or pessimism and more like vigilance. When people don’t know where things are going, they check the numbers more often.

Trends as reassurance, not inspiration

Trend articles weren’t just about what’s new; they were about confirming that others are seeing the same thing. That, to me, is a subtle but important shift. Are trends are being used as validation tools rather than directional ones?

AI: still everywhere, but asking better questions

AI remained the second-largest category, though with less volume than last year. That decline is meaningful. The headlines themselves show that the conversation has matured. Three main AI themes stood out:

AI as infrastructure, not magic

Many headlines focused on AI embedded into existing systems: search, PMS, CRM, revenue tools, rather than standalone “AI products.” This supports the idea that AI is becoming a layer, not a destination.

Search, discovery, and the loss of traffic control

A recurring topic was AI-powered search and planning tools reshaping how guests discover hotels. The concern isn’t whether AI works, but whether hotels will lose visibility, brand context, and emotional storytelling when discovery becomes more text- and answer-driven.

Uncertainty about ownership and advantage

A lot of AI headlines circled around the same unresolved question: who benefits most? OTAs, big tech, or hotels themselves? The lack of clear answers explains why AI interest remains high, but increasingly cautious.

AI is no longer just a novelty. It’s also not yet a strategy. And that tension shows clearly in the headlines.

Guest Experience & Design: the quiet constant

Guest experience and design stayed firmly in third place, again. That consistency matters. While technology and economics fluctuate, the physical and emotional hotel experience remains a stable point of interest. The dominant topics here were:

Experience differentiation rather than personalization hype

Design as a commercial lever, not just an aesthetic one

Experience-led branding versus feature-led marketing

In short: people still believe the product matters, or maybe in an AI driven future, experience makes a difference.

Brands, chains, and consolidation: noise with consequences

Hotel brands and chains appeared more frequently this year, driven largely by acquisitions, restructurings, and breakups. Three themes dominated:

Scale versus clarity

Expansion stories raise an implicit question: does more brands mean more choice, or more confusion? Incredibly there is still doubt on that topic. I’ve written about it many times.

Financial engineering meets brand storytelling

Many headlines blurred the line between brand strategy and asset strategy, reinforcing the idea that many hotel “brands” are still primarily financial constructs.

Sonder, Marriott, and symbolic moments

High-profile moves attracted disproportionate attention because they symbolized broader structural tensions in the industry.

OTAs, tech, and the PMS wars

OTAs returned to the spotlight, not just as distribution giants but as AI beneficiaries. Coverage was more balanced than in the past, less “OTA bad,” more “OTA evolving.” Meanwhile, innovation and technology coverage stayed flat overall, but PMS-related headlines increased noticeably. The subtext is clear: hotels are re-evaluating long-term tech foundations, not just adding new tools on top, the PMS Wars are on.

What quietly Moved down the list

Equally telling is what declined: direct revenue, metasearch, revenue management, regulation, climate, and social media. Social media’s drop surprised me: very little TikTok enthusiasm, almost no urgency. Reputation management nearly disappeared, which I don’t interpret as irrelevance. It has simply become hygiene. Everyone has to do it. The next evolution will likely come from AI extracting meaning from reputation data.

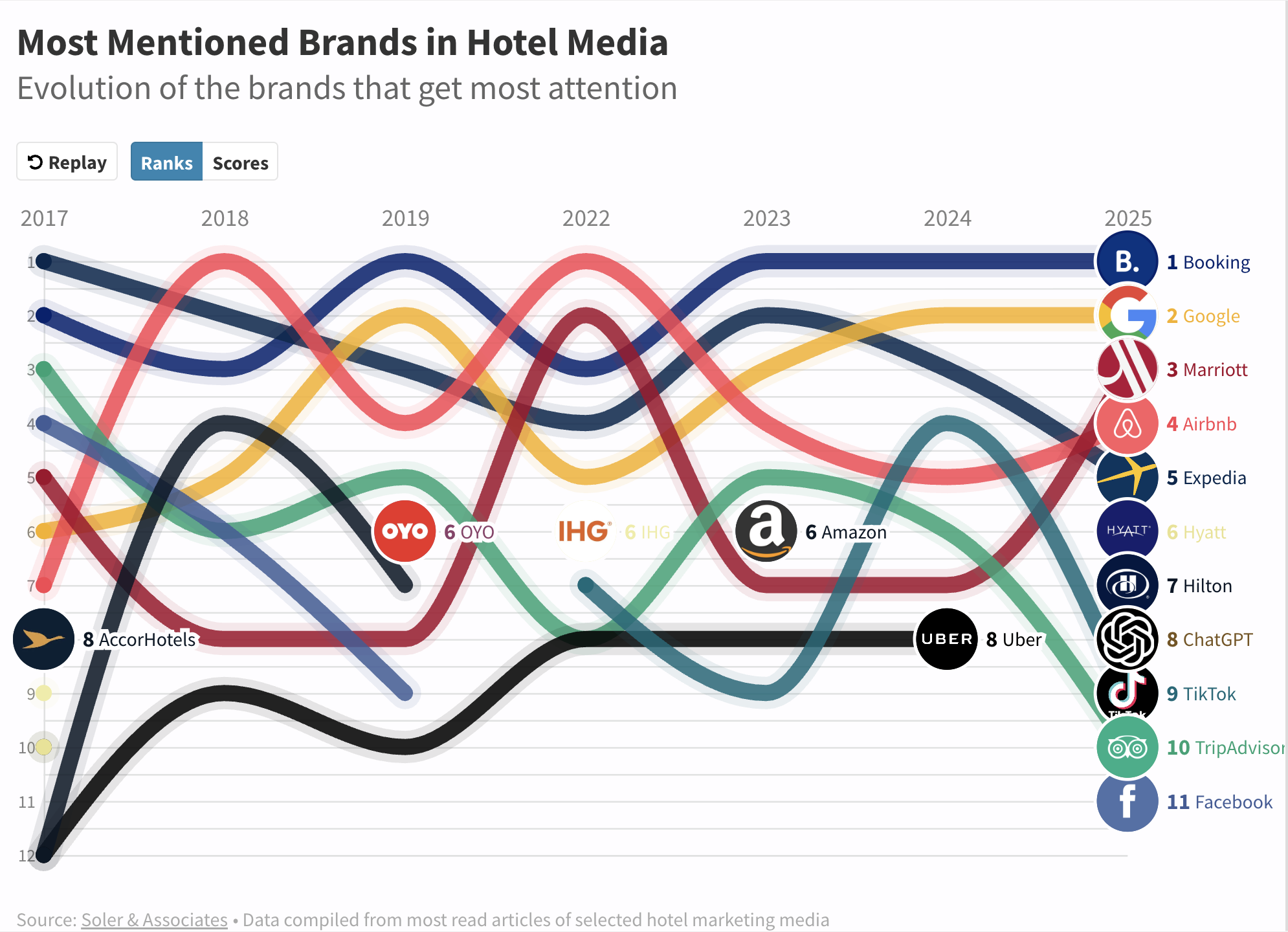

The Brands that captured the news

For this year’s brand snapshot, the ranking at the very top looks familiar, but the reasons behind it are evolving. Looking purely at headline visibility and readership, these are the brands that dominated attention in hotel and travel media, and what people were actually reading about them. Interestingly only 15% of the headlines contained a brand this year. Versus 23% last year and 25% the year before.

Booking.com: Still the 800 pound gorilla

Booking.com held onto the number one spot for the third year in a row, and at this point it’s hard to call that anything but structural dominance. The recurring themes in headlines were remarkably consistent:

Relentless product expansion, especially around AI-driven trip planning and search

Control of demand, positioning Booking as the discovery layer

Pressure on hotels, particularly around pricing power, visibility, and dependency

What stood out this year is that the tone wasn’t universally negative. Booking is no longer just “the problem”; it’s increasingly framed as the unavoidable interface between travelers and supply. That’s a subtle but important shift. Considering their global dominance as reported here.

Google: Predictable, but still unsettling

Google remained firmly in second place, largely driven by AI-related coverage. The key topics here were:

AI-powered search and trip planning, including zero-click experiences

Expansion of Google Travel surfaces, with richer visuals and summaries

Fear of traffic loss, especially among hotels and media

Nothing here is surprising anymore, but that’s exactly the problem. Google’s moves are expected, yet still deeply disruptive. The headlines suggest resignation more than outrage: hotels are starting to accept that Google isn’t just a channel, it’s an environment for the travel experience.

Marriott: A return

Marriott landing in third place is the most interesting development on this list. It’s the only hotel brand that has appeared on the chart every year, but usually much lower. This year, several themes pushed it up:

Brand portfolio expansion, and some un-expansion.

Loyalty ecosystem strength, still considered one of the strongest defenses against OTAs

Strategic acquisitions and partnerships, keeping Marriott visible to investors

What’s notable is that Marriott appeared not just as a hotel brand owner, but as a media and distribution actor.

Airbnb: Quietly climbing again

Airbnb moved up slightly from last year, driven by headlines around:

Product reinvention, especially Experiences (again)

Positioning beyond accommodation, leaning into lifestyle and discovery

Selective AI use, more restrained than the other OTAs

It isn’t clear what Airbnb’s strategy is (unlike Booking) and while trying out new ideas is excellent - maybe getting a clear plan is a good next step.

Expedia: Solid, but Not dominant

Expedia rounded out the top five, with headlines focused on:

Platform consolidation and simplification

B2B tech and private-label distribution

AI features playing catch-up rather than leading

Expedia remains highly relevant (in the US they’re a lot bigger than the rest of the world), but the headlines suggest a brand optimizing more than innovation and growth.

See the video of the race below.

The animated chart of the top brands in hotel media from 2017 to 2025. Published annually by Soler & Associates.

Methodology

This analysis is done by categorising all the most read articles according to some of the most read media in the hospitality industry. This year the top 200 articles were gathered from Hospitality.Today and HospitalityNet, two very different sources but which command a strong readership in the industry. Only the titles are used for the analysis, not the content since the titles are (most likely) what initiated the click and for this analysis we’re only interested in measuring what captured the interest of the readers, not what they read or thought about it.

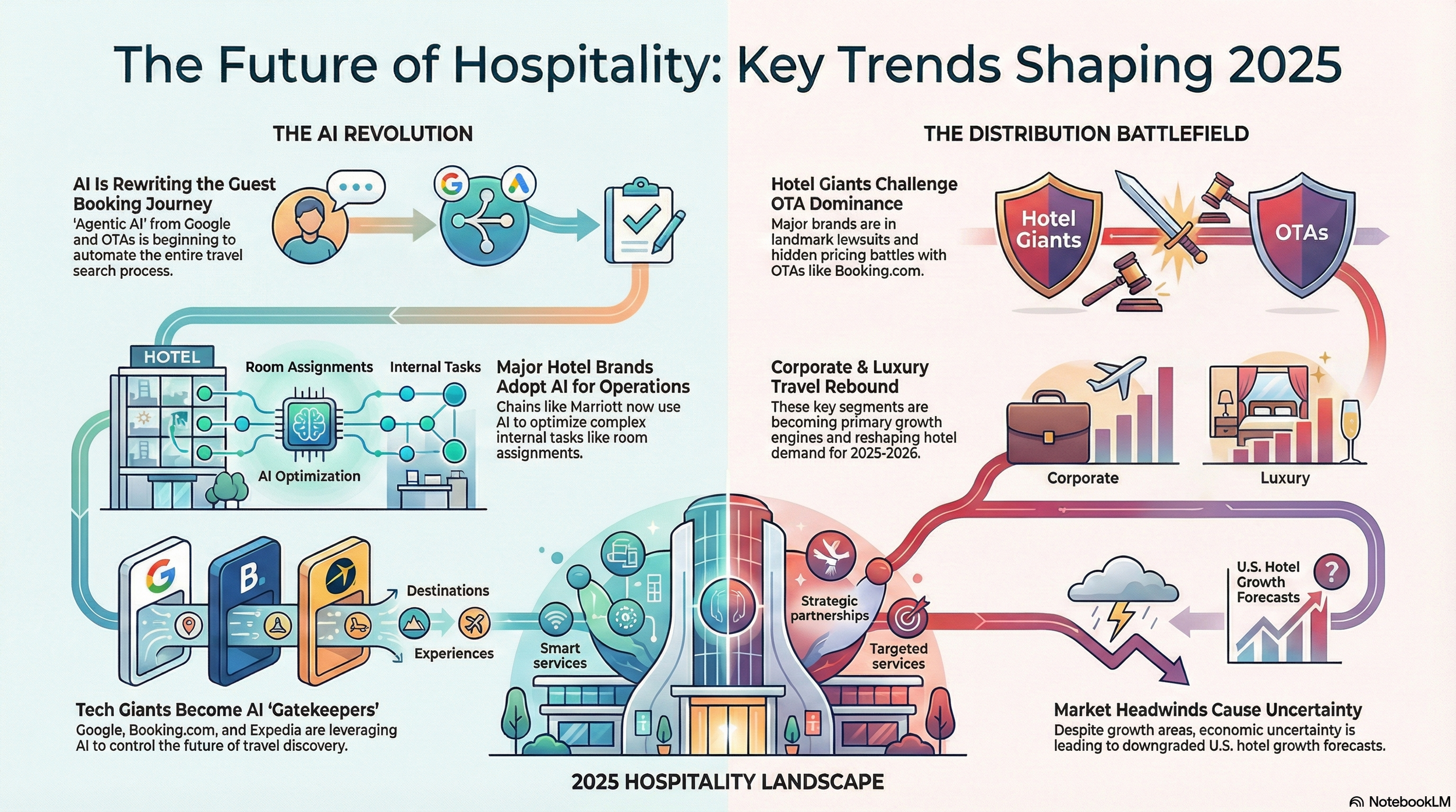

The trends according to NotebookLM

As an added bonus, here is the infographic made by NotebookLM when I uploaded all the headlines and asked it to draw it out.

And here is the NotebookLM summary:

1. Artificial Intelligence (AI) and Automation: AI is rapidly transforming the industry by reshaping hotel search, automating room assignments, and creating "agentic" booking experiences that shift the guest journey from simple search to direct sourcing.

2. Online Travel Agencies (OTAs) and Distribution: OTAs are evolving into strategic partners for hotels while simultaneously facing legal challenges, record marketing spends, and security gaps that threaten guest trust.

3. Business and Corporate Travel: The corporate sector is entering a new era of growth and transformation, driven by Gen Z’s shifting expectations, the rise of corporate housing, and a rebound in demand projected through 2026.

4. Hospitality Technology and PMS: Modernizing Property Management Systems (PMS) and adopting new standards like the Model Context Protocol (MCP) are critical for hoteliers to manage data, automate payments, and improve operational efficiency in 2026.

5. Global Tourism and Market Trends: While Europe experiences a tourism boom, other markets like Switzerland and certain U.S. sectors face declines or downgraded growth forecasts due to economic headwinds and shifting traveler origins.

6. Guest Experience and Luxury Travel: The definition of luxury is shifting toward deep personalization and branded residences, as modern guests prioritize unique experiences and personalized loyalty over traditional points-based systems.

7. Human Resources and Workforce Management: The industry is grappling with a hotel talent crisis, requiring new strategies for retaining housekeeping staff and adapting to the rapidly evolving role of the Hotel General Manager.

8. Hospitality Marketing and Social Media: Digital marketing is pivoting toward short-form video platforms like TikTok and Instagram to turn social media scrolling into direct bookings while navigating stricter meta-search rules from Google.

9. Investment and Business Development: Major hotel giants are pursuing aggressive expansion through acquisitions, new brand launches (such as outdoor hospitality), and the revitalization of existing properties to meet modern traveler demands.

10. Wellness and Food & Beverage (F&B) Innovation: Sustainability and wellness tourism are becoming core drivers of revenue (ROI), with hotels integrating creative F&B concepts and wellness offerings to differentiate their guest experience.